50

Annual Report

2013

4) Market and Competition

in the Republic of Philippines

In the past, electricity consumption in

the Philippines was limited by high

electricity fee due to limited electricity

distribution network. At present, the net

work has been improved, driving electricity

consumpt ion to moderate level or

approximately 6 per cent per year,

and is projected to remain at this level

until 2020. The country tried to lower

diesel dependence due to its high price

and at the same time promoted coal and

natural gas as major fuel source for

electricity generation and reserve. Over

75 per cent of the country’s installed

capacity is controlled by private power

producers who dominate the market

and operate large power plants.

5) Market and Competition

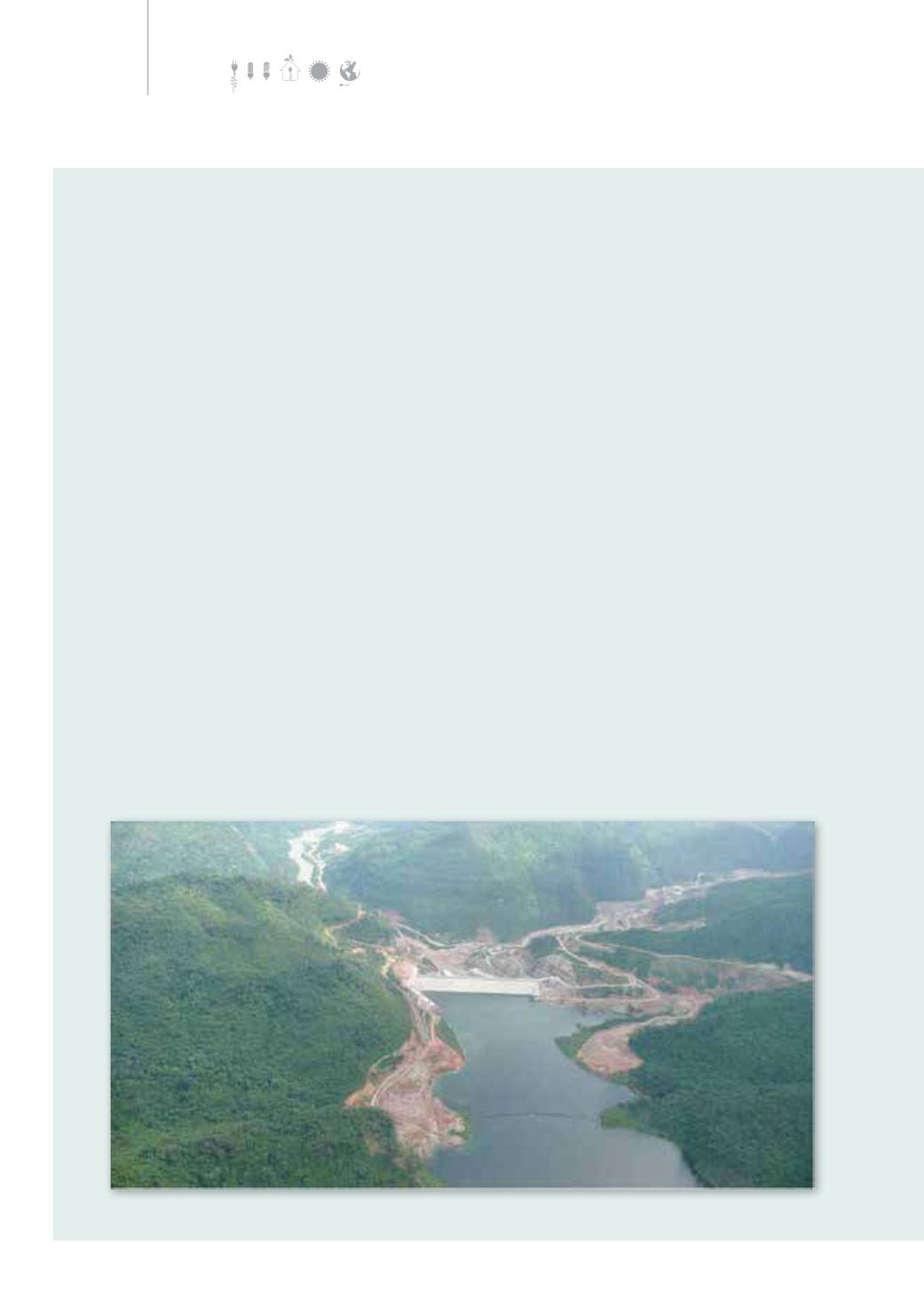

in the Lao People’s Democratic Republic

In Lao PDR, electricity consumption is

limited by the small number of population.

Approximately 80 per cent of electricity

produced in the country has been exported

to its neighboring countries, such as Thailand,

Vietnam and Cambodia. The major energy

source is hydro power. It is expected that

electricity generated from hydro power and

coal will remain the country’s major export

until 2020. Price, however, is likely to increase

as the government tried to reduce its cost

burden and tax incentives.

6) Market and Competition

in the Republic of the Union of Myanmar

After Myanmar opened its door to foreign

investors, thegovernment projected electricity

consumption in the country to increase

from 26 per cent at present to 45 per

cent by 2021 driven by domestic demand.

Hydro power and offshore natural gas are the

major energy source for power production.

However, political uncertainty and minorities

nationwide and the lack of currency stability

are major challenges and risks to foreign

investors.

2. Electricity Consumption in Thailand

It is projected that electricity consumption

in Thailand after ASEAN Economic Community

integration would grow by 5 per cent on average

Nam Ngum 2 Dam