Ratchaburi Electricity Generating Holding PCL.

21

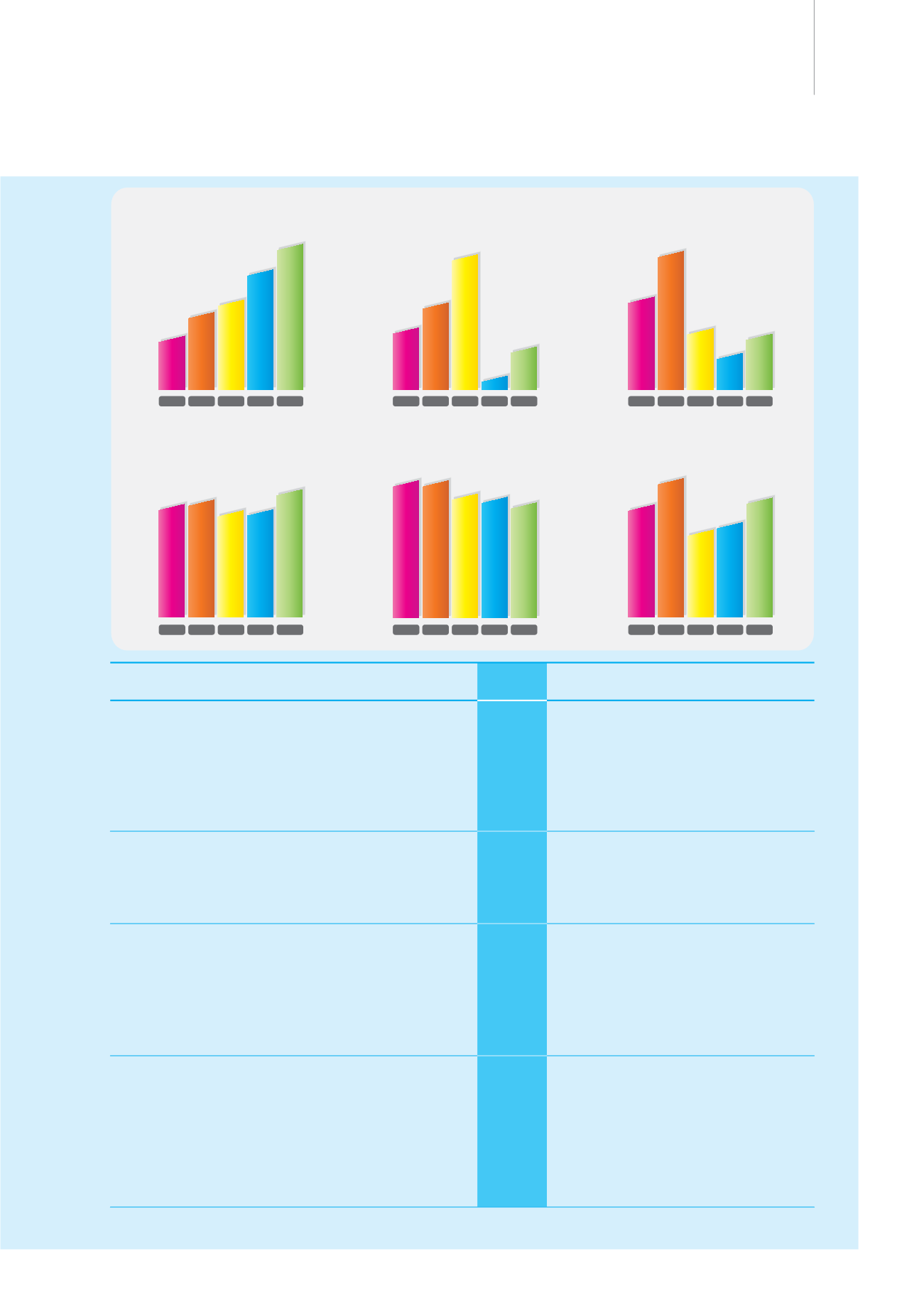

Debt to Equity Ratio (Time)

0.0

0.1

0.2

0.3

0.4

0.6

0.5

0.24

0.33

0.53

0.06

0.17

Book Value per Share (Baht)

0

5

10

15

20

25

30

35

40

37.72

36.53

33.05

32.16

30.71

Liquidity Ratio (Time)

0.0

0.5

1.0

1.5

2.0

2.5

0.91

2013 2012 2011 2010 2009

2013 2012 2011 2010 2009

2013 2012 2011 2010 2009

2013 2012 2011 2010 2009

2013 2012 2011 2010 2009

2013 2012 2011 2010 2009

1.38

1.49

1.99

2.41

Earnings per Share (Baht)

0

1

2

3

4

5

6

4.27

5.33

3.34

3.60

4.65

EBITDA (Million baht)

0

10,000

12,000

14,000

16,000

12,879

15,118

11,819

9,916

11,286

EBITDA Return on

Assets Ratio (%)

0

5

10

15

20

13.87

15.57

14.16

14.28

16.24

Year

Year

Year

Year

Year

Year

Financial Overview

2013

2012 2011 2010 2009

Profit and Loss Statement

(Million baht)

Total revenue*

53,493.79

59,213.35 45,726.07 44,187.68 37,653.83

Eearning before interest, tax,

depreciation and amortization

(EBITDA)

12,878.95

15,118.11 11,818.93 9,916.30 11,285.96

The Company’s profit

6,186.85

7,726.27 4,849.35 5,225.91 6,739.60

Statement of Financial Position

(Million baht)

Assets

88,903.25

96,810.76 97,341.84 69,581.82 69,341.82

Liabilities

33,364.39

43,079.11 48,857.36 22,905.51 24,817.69

Shareholders’ equity

55,538.86

53,731.65 48,484.48 46,676.31 44,524.13

Ordinary Share Information

Book value per share

(Baht)

37.72

36.53

33.05

32.16 30.71

Earnings per share

(Baht)

4.27

5.33

3.34

3.60

4.65

Dividend per share

(Baht)

2.27

2.27

2.25

2.25

2.25

Dividend payout

(%)

53.20

42.60

67.28

62.43 48.41

Share price at the end of accounting period

(Baht)

49.00

59.75

44.00

38.25 35.25

Financial Ratios

Liquidity ratio

(time)

0.91

1.38

1.49

1.99

2.41

Net profit ratio

(%)

11.56

13.40

10.35

11.82 17.90

Return on equity

(%)

11.49

15.32

10.26

11.47 15.77

Return on assets

(%)

6.66

8.18

5.67

7.52

9.70

EBITDA return on assets

(%)

13.87

15.57

14.16

14.28 16.24

Debt to equity ratio

(time)

0.24

0.33

0.53

0.06

0.17

* Remark: not include profit from exchange rate