Ratchaburi Electricity Generating Holding PCL.

203

Ratchaburi Electricity Generating Holding Public Company Limited and its subsidiaries

Notes to the financial statements

82

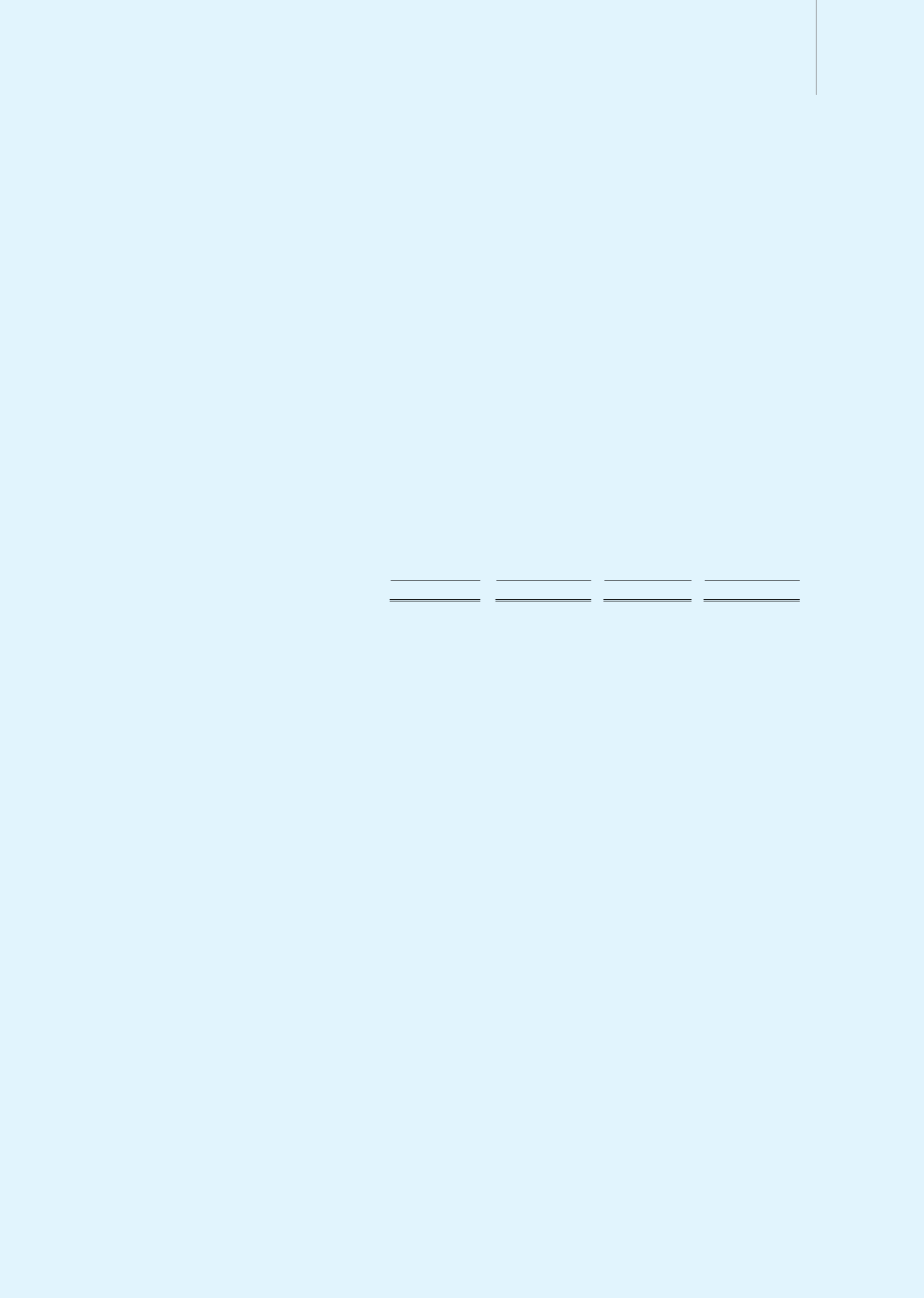

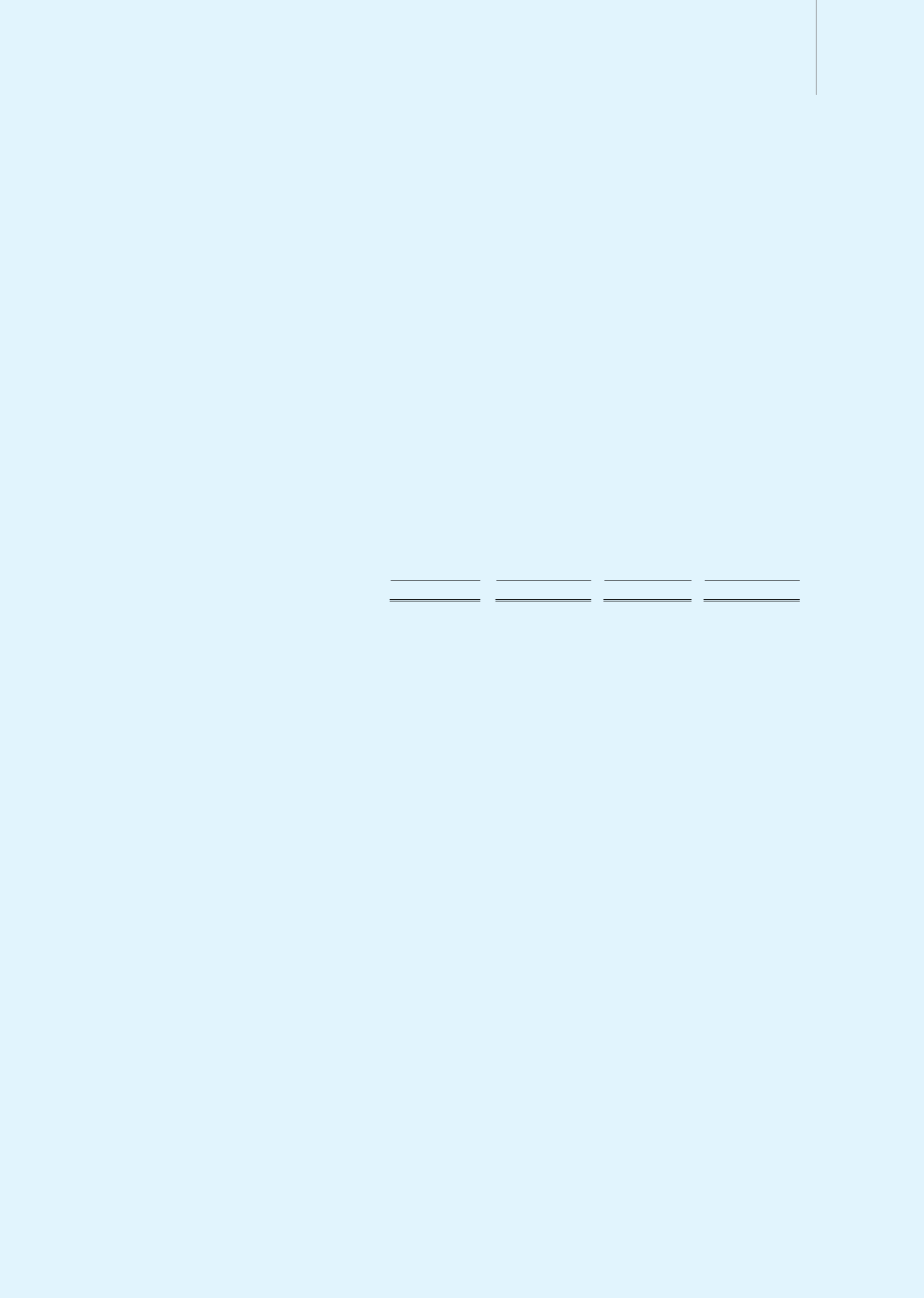

Foreign currency risk

At 31 December, the Group and the Company were exposed to foreign currency risk of significant

transactions as follows:

Consolidated

financial statements

Separate

financial statements

2013

2012

2013

2012

(in thousand Baht)

United States Dollars

Short-term loans to related parties

-

100,278

-

100,278

Long-term loans to related parties

-

-

1,172,862

1,093,943

Australia Dollar

Long-term loans from related parties

1,186,178

1,358,280

-

-

Singapore Dollar

Short-term loans from financial-

Institutions

6,724,215

-

-

-

Japan Yen

Debentures

4,639,038

5,291,570

-

-

Gross balance sheet exposure

12,549,431

6,750,128

1,172,862

1,194,221

Credit risk

Credit risk is the potential financial loss resulting from the failure of a customer or counterparty to

settle its financial and contractual obligations to the Group as and when they fall due. The Group has

concentrations of credit risk since most of its revenues are contracted under long-term agreements with

a small number of parties. However counterparties are generally government authorities and large

public or private corporations and the risk perceived is low.

Liquidity risk

The Group monitors its liquidity risk and maintains a level of cash and cash equivalents deemed

adequate by management to finance the Group’s operations and to mitigate the effects of fluctuations

in cash flows.

Determination of fair values

A number of the Group’s accounting policies and disclosures require the determination of fair value,

for both financial and non-financial assets and liabilities. The fair value is the amount for which an

asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s

length transaction. Fair values have been determined for measurement and/or disclosure purposes

based on the following methods. When applicable, further information about the assumptions made in

determining fair values is disclosed in the notes specific to that asset or liability.

The fair value of trade and other short-term receivables is taken to approximate the carrying value.

The fair value of investments in equity and debt securities, which are held to maturity and available for

sale, is determined by reference to their quoted bid price at the reporting date. The fair value of held-

to-maturity investments is determined for disclosure purposes only.

The fair value of non-derivative financial liabilities, which is determined for disclosure purposes, is

calculated based on the present value of future principal and interest cash flows, discounted at the

market rate of interest at the reporting date.

otes to the financial statements

Ratchaburi Electricity Generating Holding Public Company Limited and its subsidiaries